How Vision360 Enterprise Is Transforming Accounts Payable Automation for the Modern CFO

Published by: Vision360 Enterprise

The CFO’s Next Frontier — Intelligent Accounts Payable Automation

In a world where digital transformation defines competitiveness, Accounts Payable (AP) is emerging as a critical frontier for innovation. For decades, AP has been the last paper-bound, manual stronghold in finance — a department measured by data entry speed instead of strategic value.

That era is ending. With the rise of AI invoice processing, machine learning, and intelligent workflow automation, finance leaders are shifting from reactive bookkeeping to proactive financial management. Leading this transformation is Vision360 Enterprise — an AP automation platform engineered for CFOs who demand both efficiency and intelligence.

Why Accounts Payable Automation Matters Now

AP isn’t just about paying bills. It’s the lifeblood of working capital, supplier relationships, and cash forecasting.

Manual AP processes drain resources and introduce costly risk:

- Invoices are lost or duplicated.

- Approvals get delayed.

- Late fees and missed discounts pile up.

- Finance teams are stuck on data entry instead of strategy.

According to industry reports, manual invoice processing can cost between $10–$25 per invoice, while automated solutions reduce that to $2–$3 — a cost reduction of up to 90%. This isn’t just automation for efficiency’s sake — it’s automation for survival in a hyper-competitive economy.

The Vision360 Enterprise Approach to AP Automation

Vision360 Enterprise was designed to eliminate the chaos of traditional AP workflows through a complete, AI-driven solution that integrates seamlessly with ERP systems.

The platform unites five critical capabilities that every CFO should demand:

- AI Invoice Capture: Converts invoices from any format into structured data with near-perfect accuracy.

- Smart Validation & Matching: Reconciles invoices with purchase orders and receipts automatically.

- Workflow Automation: Routes exceptions and approvals instantly while enforcing compliance rules.

- ERP Integration: Syncs cleanly with systems like SAP, Oracle, and Microsoft Dynamics.

- Analytics & Control: Provides dashboards, audit trails, and cash-flow insights for real-time decision-making.

Together, these features deliver touchless processing, real-time visibility, and scalable accuracy — giving CFOs unprecedented control over their financial operations.

How Vision360 Enterprise Is Changing the Game for CFOs

1. From Transactional to Strategic

Finance leaders who once focused on invoice entry now use Vision360 to forecast cash flow, optimize working capital, and identify supplier inefficiencies. By automating routine tasks, CFOs can redirect their teams toward analysis, planning, and partnership with the business — turning AP into a profit-impacting function.

2. From Reactive to Predictive

AI algorithms in the Vision360 Enterprise AP automation platform detect anomalies, flag potential fraud, and recommend payment timing to capture early discounts. This proactive intelligence gives CFOs the ability to predict liquidity trends rather than merely report them.

3. From Isolated Systems to Connected Intelligence

Vision360’s ERP integration ensures that every invoice, vendor record, and GL code is in perfect sync — creating a unified data ecosystem that allows finance to move at the speed of the business.

The Measurable ROI of Accounts Payable Automation

| Metric | Manual AP | Automated with Vision360 | Improvement |

|---|---|---|---|

| Cost per Invoice | $10–$25 | $2–$3 | 70–90% lower |

| Invoice Cycle Time | 10–14 days | 1–2 days (hours for digital invoices) | 85% faster |

| Error/Exception Rate | 15–20% | <3% | 80% fewer errors |

| Early Payment Discounts Captured | <20% | >70% | 3x improvement |

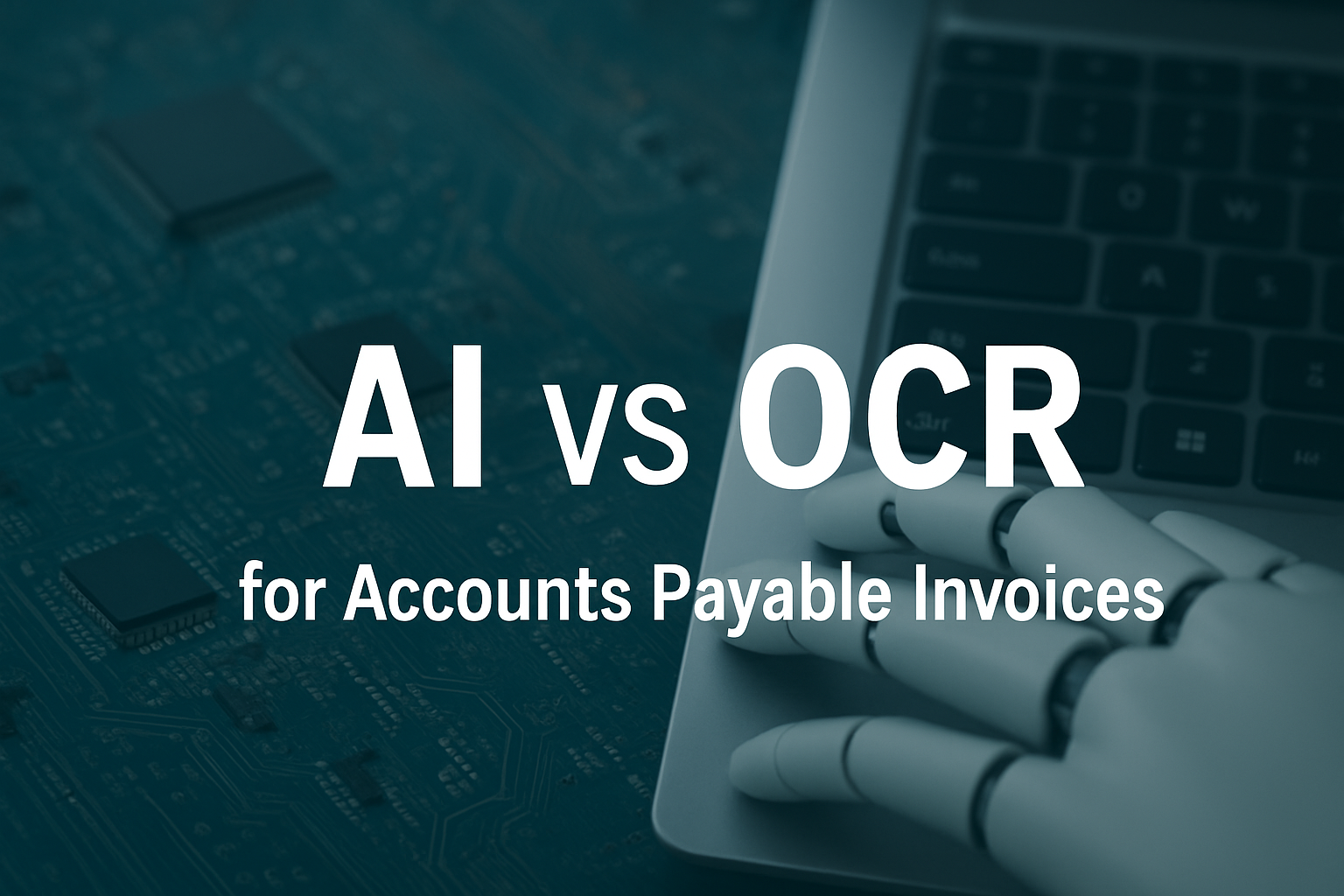

The AI Revolution: Beyond OCR

Most AP tools rely on optical character recognition (OCR). Vision360 goes further.

By combining machine learning, natural language processing, and contextual pattern recognition, Vision360’s AI doesn’t just read invoices — it understands them.

- Identifies vendor details across inconsistent layouts.

- Matches line-items to purchase orders, even when partially fulfilled.

- Learns over time to improve accuracy and reduce exceptions.

This is AI as a financial co-pilot, guiding teams toward higher accuracy and smarter decision-making.

Industry Benchmarks Validate the Shift

Independent analysts and consulting firms like Gartner, Deloitte, and PwC consistently highlight AP automation as one of the most impactful areas of finance transformation.

- Gartner notes that hyperautomation is pushing touchless invoice processing rates higher every year.

- PwC identifies AP automation as a “foundational pillar of finance digital transformation.”

- Deloitte reports that over 65% of CFOs now list automation of transactional finance among their top priorities.

Real-World Results with Vision360 Enterprise

Global Distribution Firm: Reduced manual data entry by 85% and captured 90% of early-pay discounts.

Technology Company: Cut invoice approval time by 60%, improving vendor satisfaction.

Healthcare Provider: Eliminated over 70% of paper invoices and improved audit compliance across departments.

Governance, Risk, and Compliance: Built-In by Design

- Audit trails for every approval and exception.

- Role-based access controls to protect sensitive data.

- Encryption and compliance aligned with enterprise standards.

- Configurable workflows that enforce corporate policy automatically.

Scaling Automation Across the Enterprise

- Pilot Phase: Automate a subset of suppliers or invoice types.

- Expansion: Extend automation across departments and regions.

- Optimization: Use analytics to continuously refine rules, detect trends, and improve accuracy.

Because Vision360 integrates seamlessly with existing ERP systems, scaling doesn’t require major infrastructure changes — only leadership and vision.

The Strategic Payoff: Data as a Competitive Advantage

With Vision360 Enterprise analytics , CFOs can forecast cash needs, identify vendor bottlenecks, and improve budget forecasts. In short, AP becomes a strategic intelligence hub, not a clerical function.

The Future of Accounts Payable: Intelligent, Predictive, Autonomous

As machine learning and AI evolve, AP will move toward autonomous finance — where systems self-correct, self-optimize, and self-audit. Vision360 Enterprise is already pioneering this shift, leveraging data to predict and prevent errors before they happen.

Key Takeaways for CFOs

- AP automation is foundational to finance transformation.

- Vision360 Enterprise delivers measurable results — cost, speed, accuracy, and compliance.

- AI-driven insight turns transactional data into strategic value.

- Scalability and integration make Vision360 ideal for enterprise complexity.

- Automation is not just efficiency — it’s financial intelligence.

About Vision360 Enterprise

Vision360 Enterprise is a leading provider of Accounts Payable Automation solutions that help organizations eliminate manual processes, reduce costs, and gain full visibility into financial operations. With AI-powered invoice capture, intelligent workflows, and real-time analytics, Vision360 empowers finance teams to operate with precision, agility, and insight.